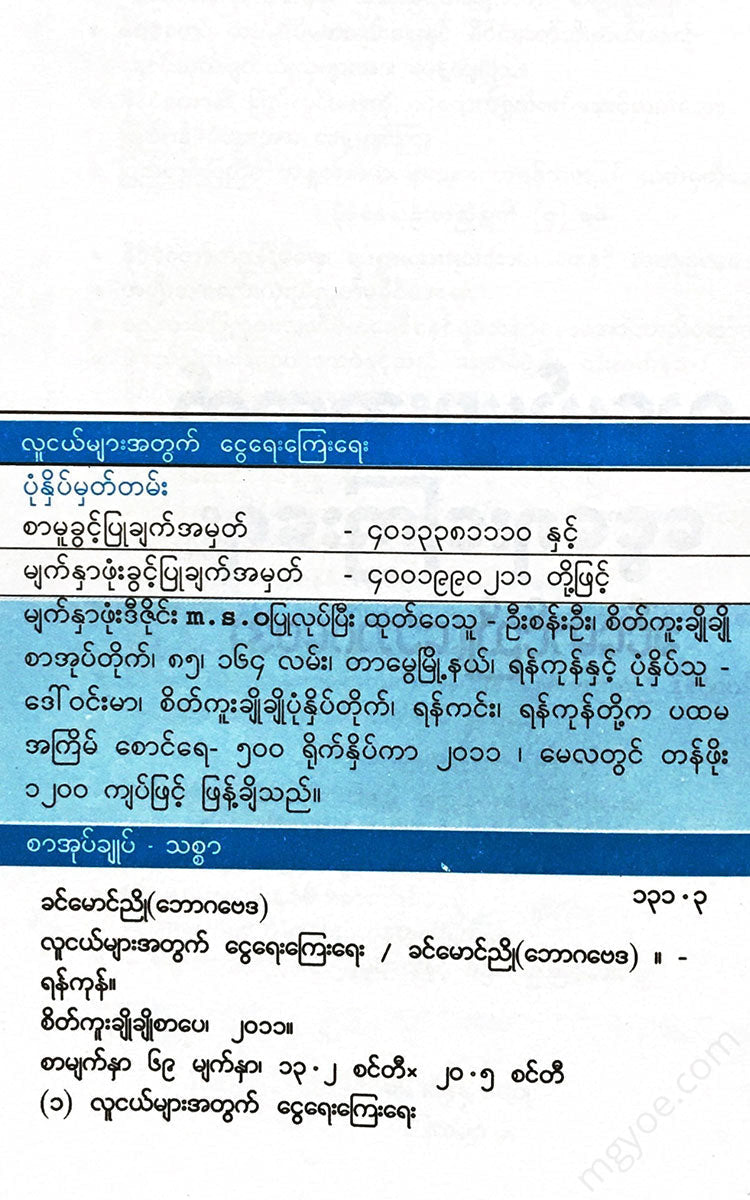

စိတ်ကူးချိုချိုစာပေ

Khin Maung Nyo (Economics) - Financial education for young people

Khin Maung Nyo (Economics) - Financial education for young people

Couldn't load pickup availability

Chapter (1)

Good life

1. Good life

We want our children to live a good life and be happy. But what is a good life? Having a lot of money, a happy marriage, or a good job?

No matter how you define the good life, money is important. But there are those who believe that the good life is made up of five (C)s. The five Cs are: Credit card, Condominium, Car, Cash, and Club Membership. This definition of the good life is not only too materialistic, but also wrong.

There are people who have to go through a lot of trouble to get those five (C)s.

Being in debt and unable to get out of it is one of the biggest pains in life. Because it can lead to the loss of everything you own, ruin your reputation, and ruin your peace of mind and a happy family life.

Youth and money

Many people are in debt because they think it is a “cultural necessity.” They spend all their savings over the course of their lives, borrowing heavily from others, on things like their children’s weddings, New Year’s Eve, and Thingyan. They don’t really need to spend a lot on these kinds of events. They don’t need to impress their friends and relatives in this way.

Another problem is that it is not only about affordability, but also about having modern appliances and equipment.

Many people are also in debt due to social problems. They are addicted to alcohol, tobacco, drugs, and gambling.

The debt trap can also tear families apart. Some parents abandon their children when they can't pay off their debts, so they don't have to worry about their own responsibilities.

So a good life means a life where you can control your life, not be controlled by banks. If you are constantly being asked by creditors for car loans, installment loans, you will not be able to control your life.

A debt trap can create a vicious cycle that is hard to break. If you are stuck paying off debt, you can't save for the future. No matter how hard you work, nothing will happen.

Therefore, we must teach our children to manage their money wisely, to save and invest for the future. To encourage them to save, we must ask them to set aside some of their savings every month. They must save first and then spend. They must not save what is left after spending. If they save after spending, they will have nothing left.

A good life is not just about money. But money is important. Without money, you cannot survive.

The most important lesson we can teach our children is that in order to enjoy a good life, we must be in control of our own lives. In order to be in control of our own lives, we must be in control of our own money. //

2. Since childhood

Kids today have more money to spend than kids in the past. They have more money than previous generations. Their attitudes toward money are influenced by their parents, the media, and their friends. The way a child spends money as a teenager will shape their attitude toward money as an adult, so it's important to get it right from a young age.

A child who manages money well is more likely to make sound financial decisions and is less likely to get into financial trouble.

But teaching children about the value of money is very difficult these days. We live in a cashless society where we don't carry much cash. They don't see people paying for goods and services right away. And with loans so easily available, managing money is even more important.

But since schools don't teach subjects like finance and financial literacy, parents have to take responsibility for teaching them. So when do we start teaching our children?

From three years old

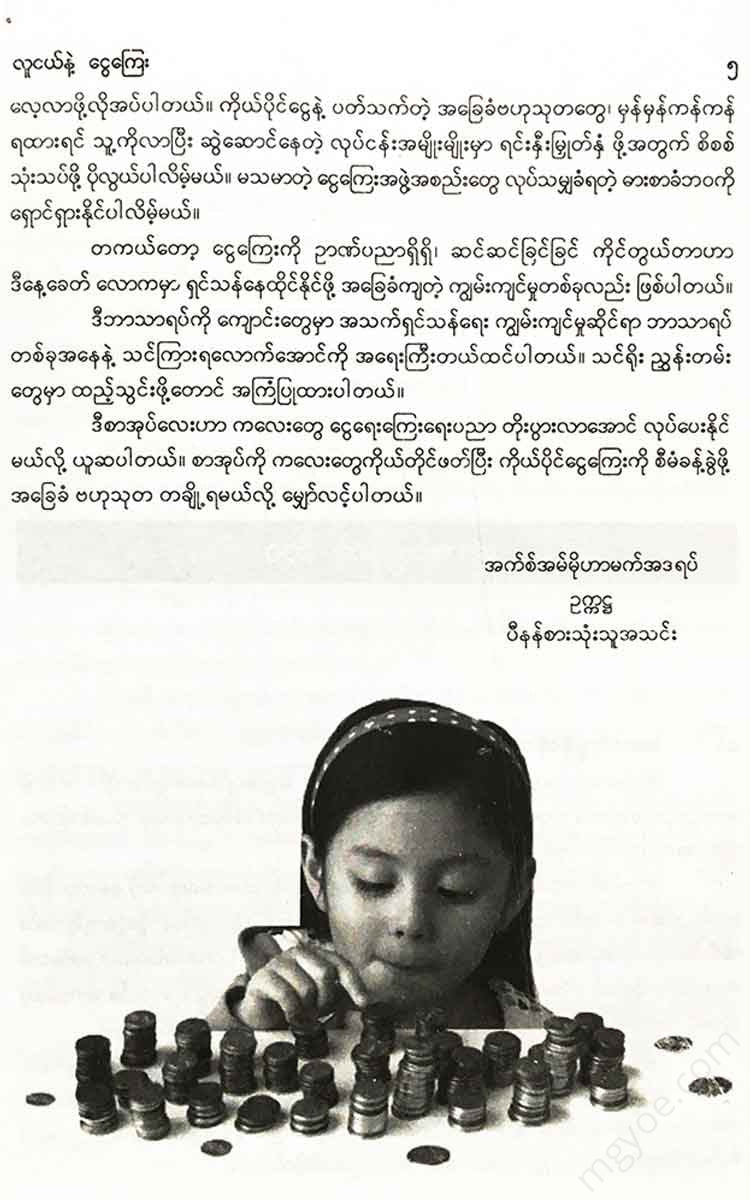

Children are not born with the ability to manage money, so they need to be taught. Parents can start teaching their children about three years old. At that age, children have a little understanding of what it means to get toys, to get food, and to pay for things. They are already aware of this when they go shopping with the family.

Set a good example.

Showing is more effective than talking. The same is true when it comes to shaping a child's attitude towards money. Children understand when parents say one thing and do another. So parents should first examine their own attitudes and behaviors. For example, they should not walk around wearing all the clothes and famous brands that they are in debt and advertise them for free.

Bread price

In addition to setting a good example, children also learn from experience. Therefore, parents should help their children develop the habit of handling money. Here, giving money is important.

Why?

A good teacher is one who knows how to give money. Children are allowed to manage their money in a safe place. The money they give is not too much, so it is not dangerous if they make a mistake. Unlike adults, they cannot lose their houses and cars with one mistake.

Giving children money can also teach them financial responsibility. For example, if a child wants to buy a new toy, you can ask them to save some of their money to get it.

Depending on your child's age, you can help them achieve their goal of buying toys. It's a good idea to have them draw up a savings plan. You can teach them how much they need to save and how long they need to save to get a toy.

Asking children to save money to buy toys teaches them that they can't have everything right away, and that they can't have everything they want right away. A child who can experience the benefits of saving money and buy toys will be less likely to be tempted to buy things in installments, like credit cards, or to pay for some things upfront and pay for others later, all for instant gratification.

Giving a gift card gives kids the opportunity to make a small mistake, one that is not too risky. It helps them to save up for a few weeks to think about what they want and value, gain a sense of expectation, and experience the consequences of overspending.

Don't give your child more money if they are overspending. If you spoil your child too much, he will never understand the consequences of overspending.

If your child is overspending, parents can borrow money to cover their expenses. You just need to make sure that you pay back the money on time and in a reasonable amount of time so that you can get into the habit of using credit.

But if your child continues to spend too much, it's time to cut back on spending.

What size?

Once you're in elementary school, it's time to start paying for groceries. You need to grow up to the age where you can buy groceries with your own money.

how much is it,

How much you give your child depends on how much you can afford, how expensive the food at the restaurant is, etc. It would be good to know how much his other friends get for their food.

Parents and children should agree on how much they will spend on groceries. Even if it's just for a snack at the bakery, you can give a little extra and get them into the habit of making decisions.

As adults, we have to make choices and think about what we spend our money on. Not all choices and thoughts are necessarily true. It is also a valuable lesson to learn from the consequences of making bad decisions and choices in spending money. So let children make bad decisions. Let them learn from their mistakes.

Often?

At first, the child is still very young and doesn't know how to handle money, so you can give him a daily allowance. As he gets older, you can give him a weekly allowance. As he reaches adolescence, you can give him a monthly allowance. The longer you wait to pay him the next allowance, the more difficult it is to manage his expenses.

Estimated usage

Spending too much is one of the lessons of money management. If you often overspend, you need to figure out why. Does your child know where they spend it and why it's gone? If you don't know how it's gone, have them keep a record of their spending. This is where budgeting comes in.

Budgeting helps you keep track of how you spend your money. You can then decide whether your expenses are really necessary, unnecessary, or justifiable.