စိတ်ကူးချိုချိုစာပေ

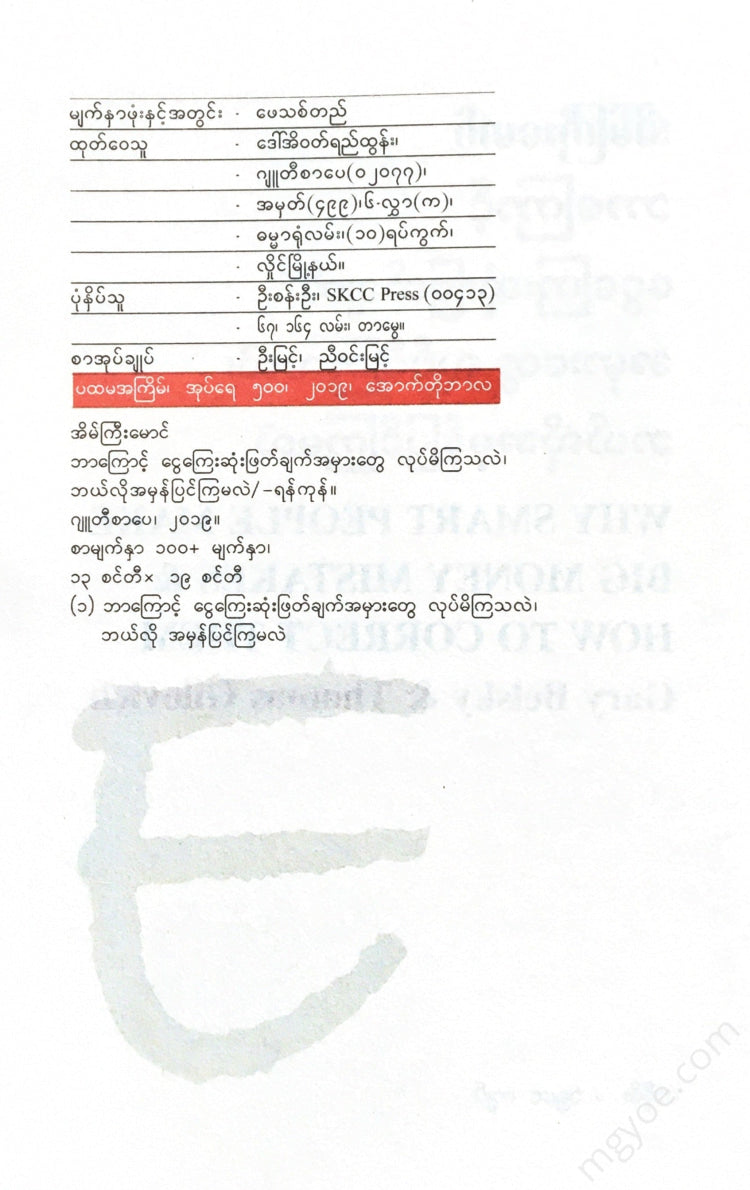

Ein Gyi Maung - Why do people make financial mistakes and how to fix them?

Ein Gyi Maung - Why do people make financial mistakes and how to fix them?

Couldn't load pickup availability

Common financial mistakes

(1) Not collecting for use when needed.

Saving money is important for life. But in the young and middle-aged, I think that there is no need to save money. Because when I was young, my parents were responsible for my health, and I just ate what my parents provided for me. Even if I needed money in the end, I could just ask my parents for it. In the same way, due to the circumstances, I didn't need to save money when I was young. I thought that saving money was nothing. When I was middle-aged, I thought that I was still strong and could still do it, so I didn't save money. At that time, I was already in the workforce and I was able to earn money. Everything was easy and convenient when I wanted it.

But saving money can be useful if you save it for something that is not easily available, but is truly necessary.

(2) No insurance was provided.

Having insurance is very important internationally. Health insurance, life insurance, car insurance, home insurance, etc. Life doesn't always go the way you think it will. Having insurance is important to be able to compensate for the occasional detour.

(3) Taking courses without interest

Even if you don't really want to take it, you often have to take endless courses because your parents or friends force you to take them. The courses are not about earning a living by teaching. They are just a waste of time and money. So, you should only take courses that you are truly passionate about.

(4) Working for money alone

When entering the workforce, you can't just focus on money. It's also important to gain experience and education. If you focus on money and do jobs that you don't have the education or experience for, you'll be laid off and have trouble moving on to the next job.

Not all dollars are created equal.

- - - - - - -

A newly married couple went on their honeymoon to Las Vegas. On the third day, they lost a thousand dollars gambling. When they returned home and went to bed at the hotel, they found a five-dollar coin in the drawer. This coin was kept as a souvenir. The coin also had the number 17 on it.

Taking this as a good omen, the groom went to the roulette wheel again. He placed a five-dollar token on the number 17. The roulette ball landed on the number 17, which was worth 35 times the amount. So his $5 was now worth $175. The groom placed his entire bet on the same number 17 again. The roulette ball landed on the number 17 again. He now had $6,125 in compensation.

This increased and the number of winnings on the 17th number increased to a total of $7.5 million. The casino manager was shocked. No one had ever won such a large sum of money.

The groom stubbornly placed his $7.5 million bet on the number 17, which he believed was his lucky number. This time, the roulette ball stopped at number 17 and landed on the next number, number 18.

The groom had to forfeit all the money he had won. So the groom returned to the hotel where he was staying. When he got back to the hotel, his new wife asked him:

"Where are you going?"

"I'm going to play crazy."

"how you been"

"Not bad. I only lost $5."

This story is just a joke about a roulette wheel. However, like this incident, some people run their businesses like gambling. Because they think that gambling is an easy way to make money, they treat other things like gambling.

It is important to know that the practical business field is

It is completely different from the nature of gambling. In gambling, you can rely on luck, but in business, you can only be successful if you make the right decisions. If you make the wrong decisions about money, you will definitely lose.

So, I will continue to explain what factors should be used to base decisions on.