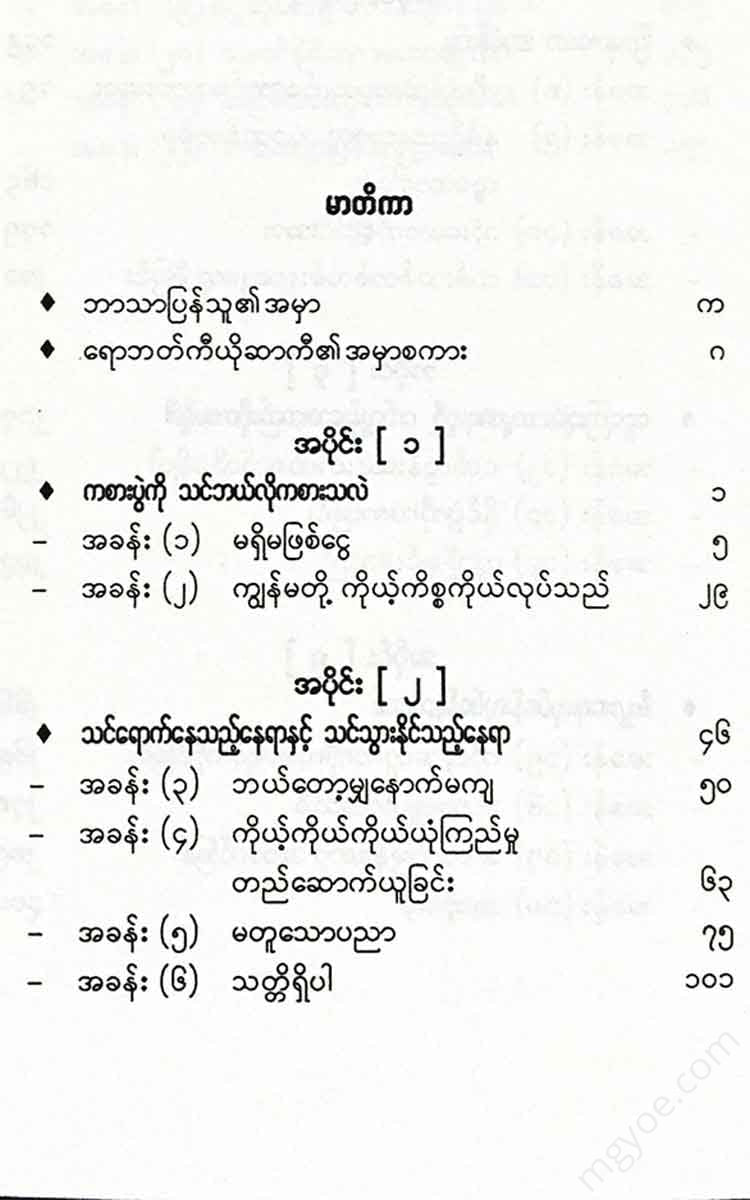

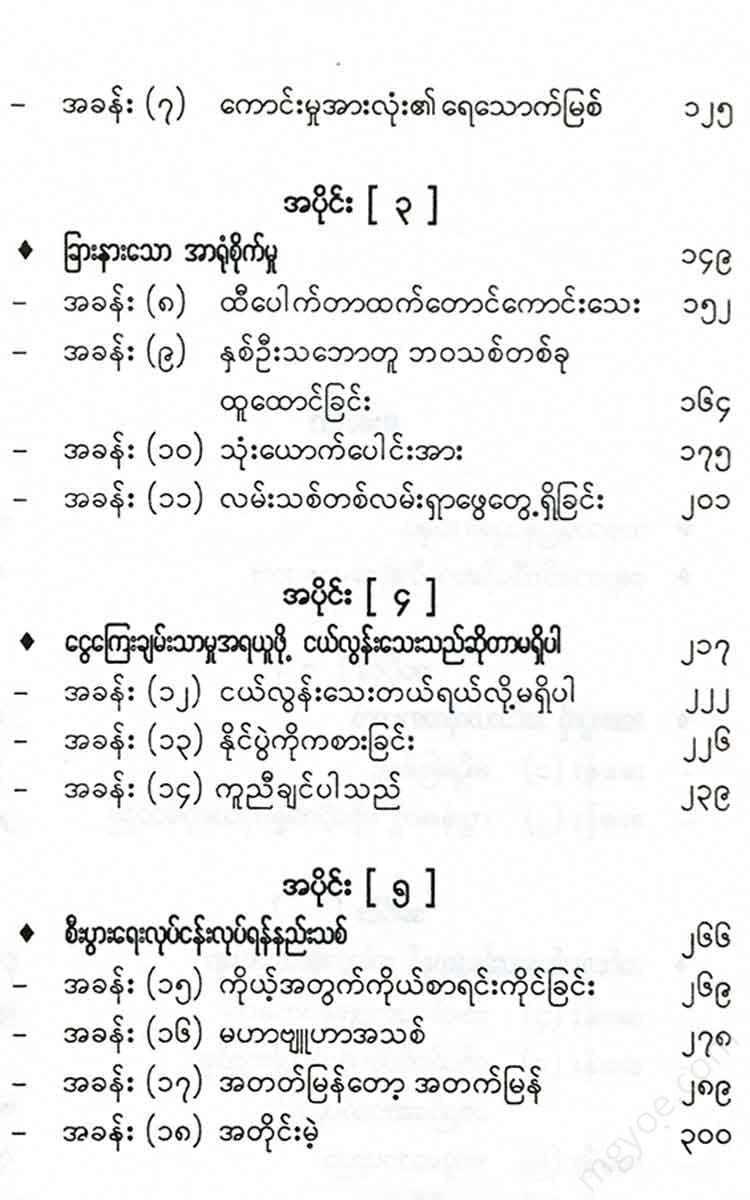

စိတ်ကူးချိုချိုစာပေ

Myat Nyein - About those who trampled on the land

Myat Nyein - About those who trampled on the land

Couldn't load pickup availability

If you want to achieve financial security, you need to learn about the game of money. I learned about the game of money from my father, Rich. From my father's lessons, I developed the "cash flow" game.

The game teaches us financial skills by playing it over and over again. The game is so unique that we are giving away the game rights. The game will challenge you. It will teach you. And it will make you think like a rich person.

The authors in this chapter describe their financial successes and credit their success to the cash flow game.

Participants in this game not only improve their financial skills but also increase their self-confidence.

Ed and Terry Coleman, who live in California, got interested in real estate by playing the game. Their way of creating a financially secure life is a lesson that many people can learn from. If you grew up in the 1960s like them, you too were influenced by the “hippie culture.” In the hippie culture, financial security was not their goal. They lived without constraints. They forgot about money. And they did what they liked. Thinking about the future was a waste of time.

Ed and Terry were very open and honest about their old views on money. Like many people of their generation, they followed the dictates of the times. They blamed those who talked about money. They spent what they could. They didn't have to plan for the future. (At least not until their son, Jade, was born.)

When they realized they needed a financial plan, they explored many options. Some options worked, some didn't. But they didn't give up. They kept learning. Because they wanted to find a way to build a financially independent life.

Finally, they realized that investing in real estate was the best opportunity to establish a life of financial independence. You will see how they did it and how small steps turned into big steps.

If you are in your thirties, with debts piling up and you are worried about whether you will ever be financially secure, read Tracy Rodrigues's "We Do Our Own Business." Like many others who have filed for bankruptcy, Tracy and her husband are facing a huge financial crisis. They are hardworking people. However, they inevitably face financial difficulties. For them, financial security began with starting their own business. The idea for doing so came from playing the cash flow game.

You may be in your fifties. And you may think that building a cash-flowing investment business is not your job. I’ve heard people your age say things like, “It’s too late for me,” “I can’t do it anymore,” and “I’m too old to make changes.” If that’s what you believe, read Cecilia Morrison’s “It’s Never Too Late.”

The stories of Ed and Terry, Tracy and Cecilia, and how they shaped their lives are shaped by their choices. The decisions they have made and the decisions they will continue to make are inspiring. They are successful people who have achieved financial security. They are winners in the game of life.

Chapter - 1

Essential money

Ed and Terry Coleman

Let's say. We're going to watch a movie. The story is about free thinkers in the 1960s who became renters for the Şoa usos o opozoi saooze 8:93:67: coroas. Let's say it's a Hollywood fantasy movie. But the story is a true story. For the past three years, Terry and I have been in the home buying business. We now own eight homes in three states. Total value is over a million dollars.

Why and how did we change? We changed dramatically. We went from a life of financial turmoil to a life of financial success. This is a story that shows how much people have changed in our generation.

A scene

Before we started our real estate business, our situation was not very different. Money was never talked about in our home. It was never discussed. I was not taught about money, so I didn’t know much about it. My parents and I thought I was irresponsible when it came to money. I was the type of person who would spend it as soon as I got it. In contrast, my sister, who is “responsible,” always saved her money.

Education is considered a virtue, a good thing. However, it is never taught that you need to be well-educated to have a stable career and a good life. You need to be well-educated to be a well-rounded person. My younger sister graduated from college. I dropped out of college after three years.

I was living in Los Angeles, and Terry was living in New York. She had been attending college in California for two years. We met in 1980 and married in 1987. We both lived the hippie lifestyle of the 1960s and 1970s. We thought of money as a system that was “abhorrent, abhorrent, and capitalistic.” Money was not important. Most of our generation didn’t care about money. It was shameful to care about money. We lived from month to month. The goal of accumulating a lot of money didn’t even cross our minds. Living together without getting married was the way of life of our time. In short, we didn’t understand or know anything about money. We didn’t even bother to try to understand or know anything about it.

Five years ago, we were in our thirties and working in the film industry. I got into the film industry by accident. My father was a cameraman and director, so I unexpectedly became an assistant cameraman. My education was in graphic design and photography, which allowed me to do what I loved. I wasn't working just for the money.

One day, Terry came to the set. She saw the special effects of the makeup artists. She fell in love with the art and became a makeup artist herself.

We do a lot of commercials. And then we travel a lot. We stay in hotels. We can live very well, so to speak. We both work one job after another. We have many fifteen-hour days. We have ten to twenty days like that a month. But the rest of the time is our own time. We go to the beach. Or if we want to play tennis, we just play tennis. Our goal is to spend money. To waste money. We move from moment to moment and enjoy ourselves. What if life is fun?

On the surface, our life was free. Unfettered. Peaceful. But fourteen years ago, our life changed when our son, Jake, was born. His arrival into the world was a wake-up call. We had no plans for the future. What would happen in ten or twenty years? We had no plans for our son, and no plans for our marriage. We had no goals. No assets. No investments. No way out of the terrifying predicament we were in. “So… what are we going to do?” we asked ourselves. While I was at work, Terry stayed home with Jake.

Unfortunately, my work schedule can be chaotic. Sometimes I travel for weeks at a time. When my son gets older and notices that I’m not home, he asks, “Where’s Daddy?” We don’t know what to do. I can’t give up the film industry. I can’t give up. It’s the industry I understand deeply. I can’t even imagine working in any other industry, even if someone else offers me a job. I know we have to make changes. But where do we start?

It's time for us to think and act like adults.

Shooting year

Let me set the scene for you. It's 1992, and Terry and I are ready to focus on our future business. We're at a park on a sunny California morning. I'm carrying my baby in my arms. Another father is also watching the baby. This day is certainly different from any other day. Because it's a weekday at a park.