စိတ်ကူးချိုချိုစာပေ

Maung Bo (Myan Aung) - Various perspectives on poverty

Maung Bo (Myan Aung) - Various perspectives on poverty

Couldn't load pickup availability

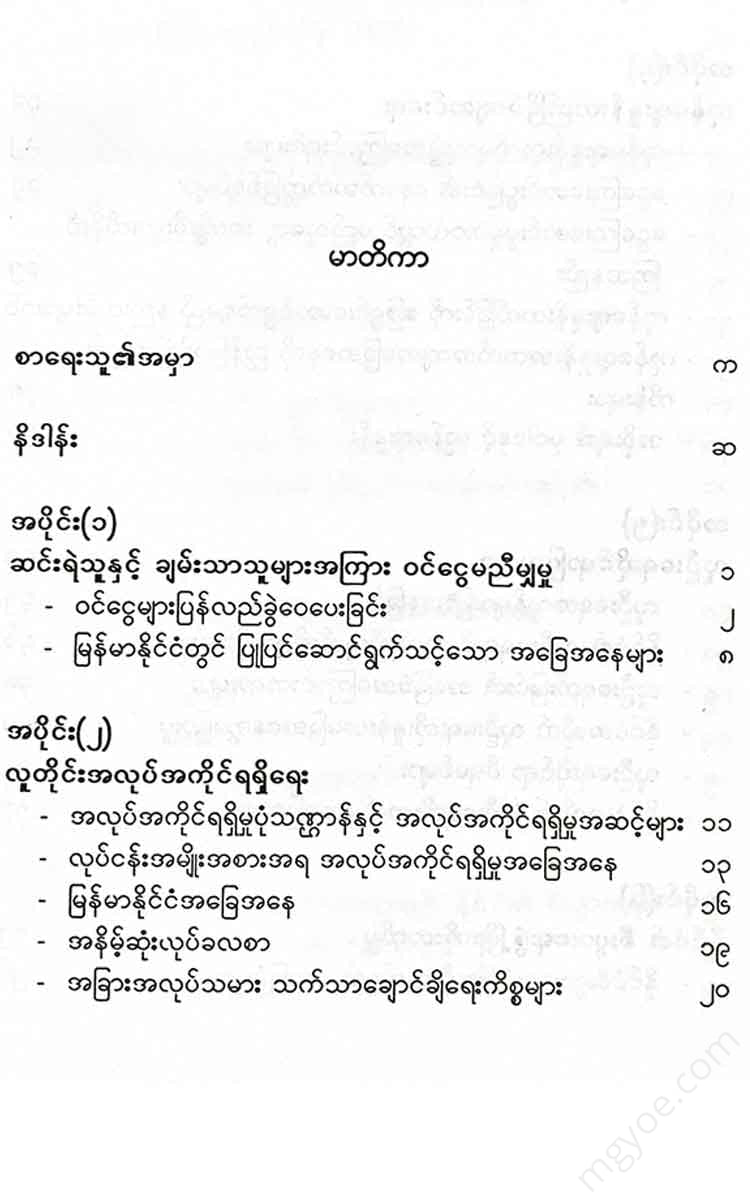

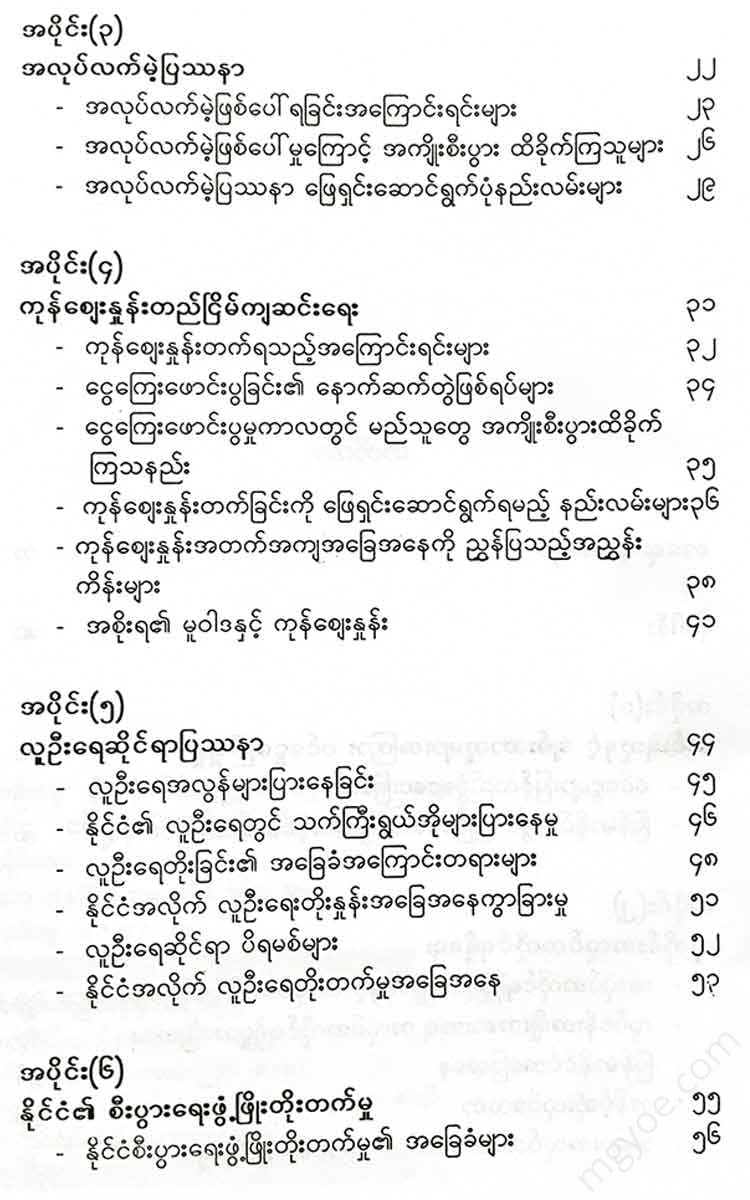

Part (1)

Income inequality between the rich and the poor

When studying poverty, one common theme that is found in many countries is the inequality of incomes between the rich and the poor. A 2007 study by economist Emmanuel Saez found that the income gap between the rich and the poor in the United States is so large that the top 0.01% of earners in the country take in 6% of all earned income in the United States. This finding suggests that even in a country like the United States, the income gap between the rich and the poor is large.

Many governments in various countries implement various forms of redistribution of incomes to address income inequality between the rich and the poor within the country.

Redistribution of income

Redistribution of incomes is carried out in the following three ways to address the income gap between the rich and the poor in the country.

(a) Government spending: Allocating government revenue to activities that benefit the poor.

(b) Providing subsidies to poor communities and individuals

( c) Redistributing income to the poor by collecting more taxes from the rich ( Taxation)

The first method, which is government fiscal allocation, involves allocating government revenue and other revenues to projects that will benefit the poor more. For example, building roads in poor rural areas, or allocating funds to projects that will benefit education and health in poor areas.

The second method, government subsidies, involves providing financial support and distributing food and consumer goods at low prices to poor communities and individuals, and subsidizing industries that produce goods that poor people consume, so that producers can produce goods at low prices and sell them to the poor in the market at low prices.

The third method of tax collection is to collect more taxes from the wealthy and use the collected money for public goods. Public goods are activities that benefit the public, such as building roads, repairing roads, providing electricity, etc.

Here , I would like to present the practical implementation of income redistribution in India. The Indian government has also implemented various income redistribution programs for the poor in the country. It has provided food subsidies to the poor and public goods to the rural areas. In 1950, the Indian government implemented the Public Distribution System (PDS). Under this program, supply depots were established in many places and basic food was distributed to all. In 1997, the program was changed and the distribution of food was focused on the poor. Under this program, the poor could buy basic food items at about half the actual cost. Since 2000, the poorest 15 percent of the poor have been able to buy basic food items at cheaper prices. The distributions have included the sale of 35 kilograms of rice or wheat per month at a very low price of 2 Indian rupees per kilogram.

The second redistribution program of the Indian government was the distribution of public goods, which was introduced in 1970 under the Minimum Needs Plan, which provided clean water , school health facilities, electricity , and rural roads.

By 2010, India had built primary schools in every village, expanded electricity supply, and expanded piped drinking water to rural areas.

As mentioned above, there is a mechanism to address the income inequality between the rich and the poor, which is called taxation. Therefore, I would like to present a complete explanation of taxation. Taxation is the process by which individuals or businesses pay taxes to the government at a set rate from their income. The government collects taxes from the public for the following purposes:

( a) Collection of revenue to meet the needs of the state's expenditures.

In ancient times, rulers collected taxes to cover the costs of their administration and the expenses necessary for waging war. Nowadays, taxes are collected to cover the costs of various departments of the state government, for example, building schools, hospitals, roads and bridges, and expenses for the military and police for national defense and security.

( b) Taxation to prevent certain business activities

For example, cigarette smoking and alcohol consumption can cause negative effects on public health, morals, and discipline, so imposing heavy taxes on the production and sale of cigarettes and alcohol is a way to discourage both the production and consumption sectors.

( c) Taxation to prevent certain imports.

Some imports are not wanted to be imported into the country, so they are hindered by imposing heavy taxes.

( d) Collect more taxes from the rich and spend them on projects that benefit the poor.

In this way, they are addressing the income inequality between the rich and the poor in the country.

It has been mentioned that one way to address income inequality between the rich and the poor is to provide financial and material support (subsidies) to the poor. If we were to present the methods of providing subsidies in detail, there are four types of subsidy activities as follows.

( a) Supporting manufacturing industries that are important to the country

For example, the government provides financial and technical support to farmers who produce food that is essential for the country to increase their productivity. This support will lead to more productive activities for these farmers, which will lead to more agricultural and food products for the country, as well as increased income for these farmers.

( b) Supporting new manufacturing or industrial enterprises to gain momentum when they start production.

New manufacturing and industrial enterprises initially face difficulties due to competition in the market. If the government provides financial, material, technological, and marketing support, new manufacturing and industrial enterprises will gain momentum and be able to compete with other enterprises in the market.

( c) Businesses that are failing due to lack of success or operating with a large number of employees, providing all-round support to help the business recover;

If this is not done, businesses will collapse and unemployment problems will arise, so the government needs to support such businesses.

( d) If a local business is in a situation where it cannot withstand the competition of foreign companies and is about to fail, the government should provide all-round support to the business until it can compete with foreign companies.

In the near future, when Myanmar becomes a member of the ASEAN Economic Community (AEC), companies doing business in Myanmar will face competition from businesses in other countries within the ASEAN Economic Community (AEC). In addition, as economic sanctions are eased, foreign investment will have to compete with local businesses. Therefore, it is necessary to make preparations now to face the challenges of competing with businesses in other countries.

When a domestic manufacturing or agricultural industry receives government funding and other subsidies, the industry can produce more goods and produce them at a lower price, which can have two benefits: It can increase domestic production by producing more goods and it can also help lower domestic prices by producing them at a lower price.

Here is a case study from Malawi, a country in Africa. In 2005, a drought in Malawi severely affected agricultural production, with about 40% of the country’s population suffering from hunger and requiring food aid from foreign countries. In 2007, Malawi experienced good rainfall, allowing the country to export its main agricultural product, maize. This improvement in agricultural production was not only due to improved weather conditions, but also to the government’s support for agricultural production with good quality seeds and fertilizers at affordable prices. As a result, maize production in Malawi increased from 1.2 tons per hectare to 2.2 tons per hectare. Similarly,